New data from the U.S. Department of Education (ED) looks at 7.4 million borrowers who are in default on a collective $157 billion in federal student loans. The data release is a prelude to negotiated rulemaking sessions next week in which ED will consider which borrowers should be eligible for loan discharges under its second attempt at mass loan forgiveness.

ED released draft regulatory text outlining the types of borrowers currently being considered for relief. Rather than pushing a universal loan-cancellation program, ED proposes cancelling debt for certain categories of borrowers, such as those whose balances have risen. Most of these borrowers would be eligible for partial relief of $10,000 or $20,000. However, borrowers whose loans first entered repayment more than 20 or 25 years ago could be eligible for a full discharge of their debts.

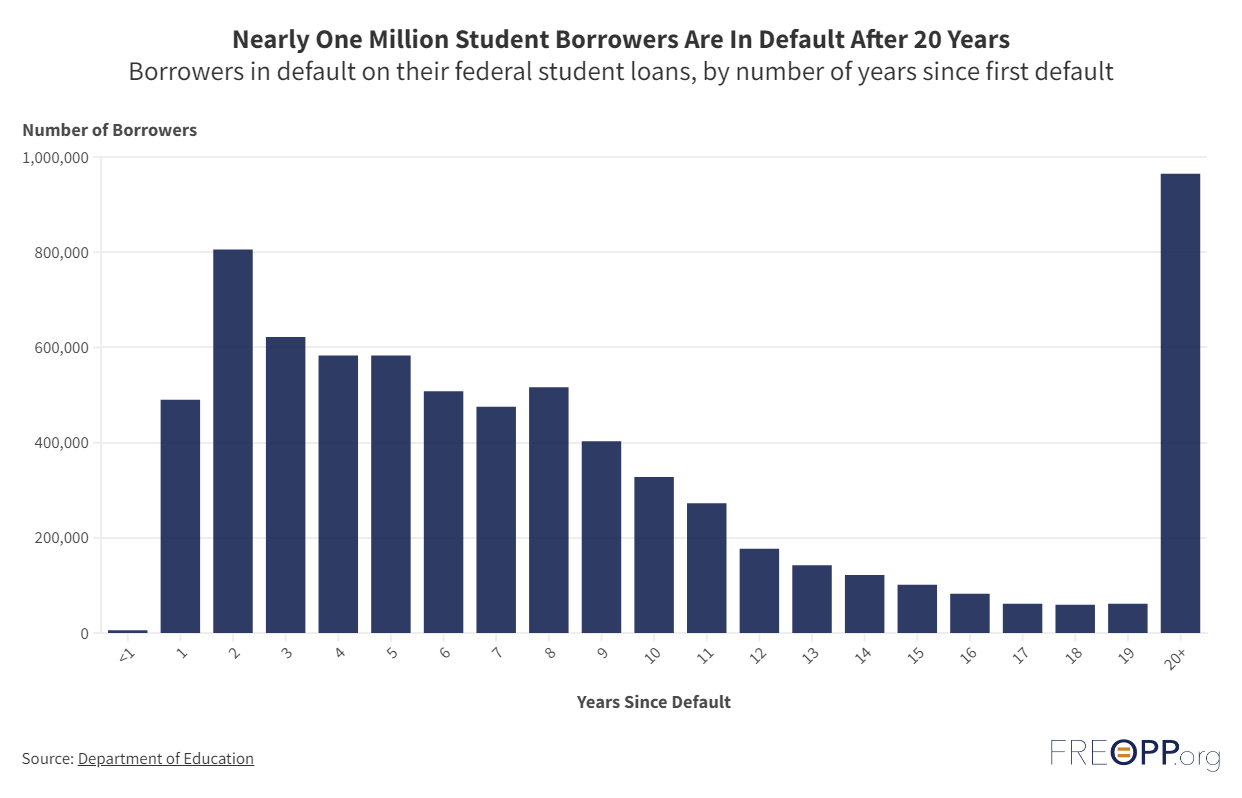

The data release on defaulted borrowers is intended to bolster ED’s case for cancelling these debts. Nearly one million borrowers first defaulted over 20 years ago and still have outstanding defaulted loans today. These individuals owe a collective $13.2 billion, and most will probably never pay off their loans.

Borrowers default on their federal loans when they fail to make a payment for 270 days straight. Once a borrower defaults, ED—or a contractor working on its behalf–is empowered to collect balances due by garnishing defaulted borrowers’ wages, seizing their Social Security checks, or withholding their tax refunds.

These measures are extreme, but often effective at recovering defaulted balances. Over 30 percent of borrowers who default nonetheless repay their loans in full within five years, according to research I conducted at the American Enterprise Institute. ED has previously estimated that the share of defaulted student loan balances that are eventually recovered is quite high: between 75 and 80 percent.

But not every borrower has wages to garnish or tax refund checks to seize, and for some of those who do, the funds may be insufficient to pay down the loan. Some borrowers therefore remain in default for decades, with little prospect for retiring their debts.

Between 2016 and 2021, ED collected just $446 million on the loans of borrowers who had been in default for more than 20 years; that isn’t sufficient to cover one year’s interest on these borrowers’ outstanding balances. More than 75 percent of long-term defaulters saw no collections on their loans at all. Voluntary payments were even rarer: just three percent of long-term defaulters willingly made payments towards their loans over that five-year period, compared to 15 percent for borrowers who had been in default for less than a decade.

Granted, some of the period studied here (July 2016 to July 2021) covers the COVID-19 pandemic, when payments and collections were suspended. But the majority of the time period covered was pre-pandemic.

Because the prospects for recovering balances from long-term defaulters are slim, private lenders typically write off defaulted loans as uncollectible after a set period of time. The federal government has more tools at its disposal to collect—not to mention fewer front-end safeguards to ensure loans don’t go to borrowers who can’t afford them—so it’s reasonable for that time period to be longer than in the private market. But the idea that the federal government should have a process to discharge uncollectible loans should not be dismissed out of hand.

However, there are two main problems with the way ED is going about it. First, the agency’s proposal to cancel debts for borrowers who entered repayment 20 years ago (if they have only undergraduate loans) or 25 years ago (if they have some graduate debt) is not restricted to defaulted or struggling borrowers. People who entered repayment in the early 2000s and chose a long-term repayment plan—popular among medical and law school graduates—might still be paying off that debt today, and could reap enormous rewards from the cancellation scheme.

Second, Congress has not authorized any such large-scale cancellation program, so ED has no authority to go it alone. There is good reason for that: major changes to the student loan program should not happen without other policy changes. If Congress were to allow ED to write off uncollectible debts, that should accompany reforms to ensure the federal government gives out fewer uncollectible loans going forward. ED itself still estimates lifetime default rates of 30 to 35 percent for undergraduate borrowers.

Many of those defaults are avoidable. The federal government should not fund colleges and universities where most students don’t increase their incomes enough to earn back the cost of college. If the federal government wants to write off uncollectible loans, it also needs to make far fewer loans going forward.