President Biden has released his latest fiscal proposal, the “American Families Plan,” which proposes $1.8 trillion in new spending over 10 years, funded by tax increases. My FREOPP colleagues will be posting on some of the spending provisions throughout the week, but in this post I wanted to highlight a Twitter thread I've posted on the tax provisions of both this proposal and the previous one, the “American Jobs Plan.”

The $1.9T stimulus bill was pure deficit spending, without offsetting cuts or taxes. Now, Biden proposes massive tax hikes to pay for the new $4.1T of spending. These hikes will crush job and wage growth, kill investment in startups, and drive businesses to flee the country.

— Avik Roy (@Avik) April 28, 2021

The two core components of Biden’s $4 trillion in tax increases are a doubling of the federal capital gains tax rate from 23.8% to 43.4%, and an increase in the corporate income tax rate from 21% to 28%.

Both of these taxes would harm lower- and middle-income workers, first and foremost by badly damaging economic growth (that is to say, job growth and wage growth).

The capital gains tax hike would actually reduce tax revenue, because investors would change their behavior to avoid the tax. For example, investors would likely choose not to realize existing investment gains, e.g. not selling stocks whose prices have gone up, and also avoid future investments in dynamic industries whose rewards would now be lower than their risks.

The center-left economists who run the Penn Wharton Budget Model estimate that the doubling of the capital gains tax rate would actually *decrease* revenue by $33 billion from 2022-2031. https://t.co/d0V7heYum6

— Avik Roy (@Avik) April 28, 2021

Investors would also reduce funding for startups—which provide 40% of net new jobs—because they would be more hesitant to sell existing investment holdings (and pay taxes on the gains) to invest in new companies.

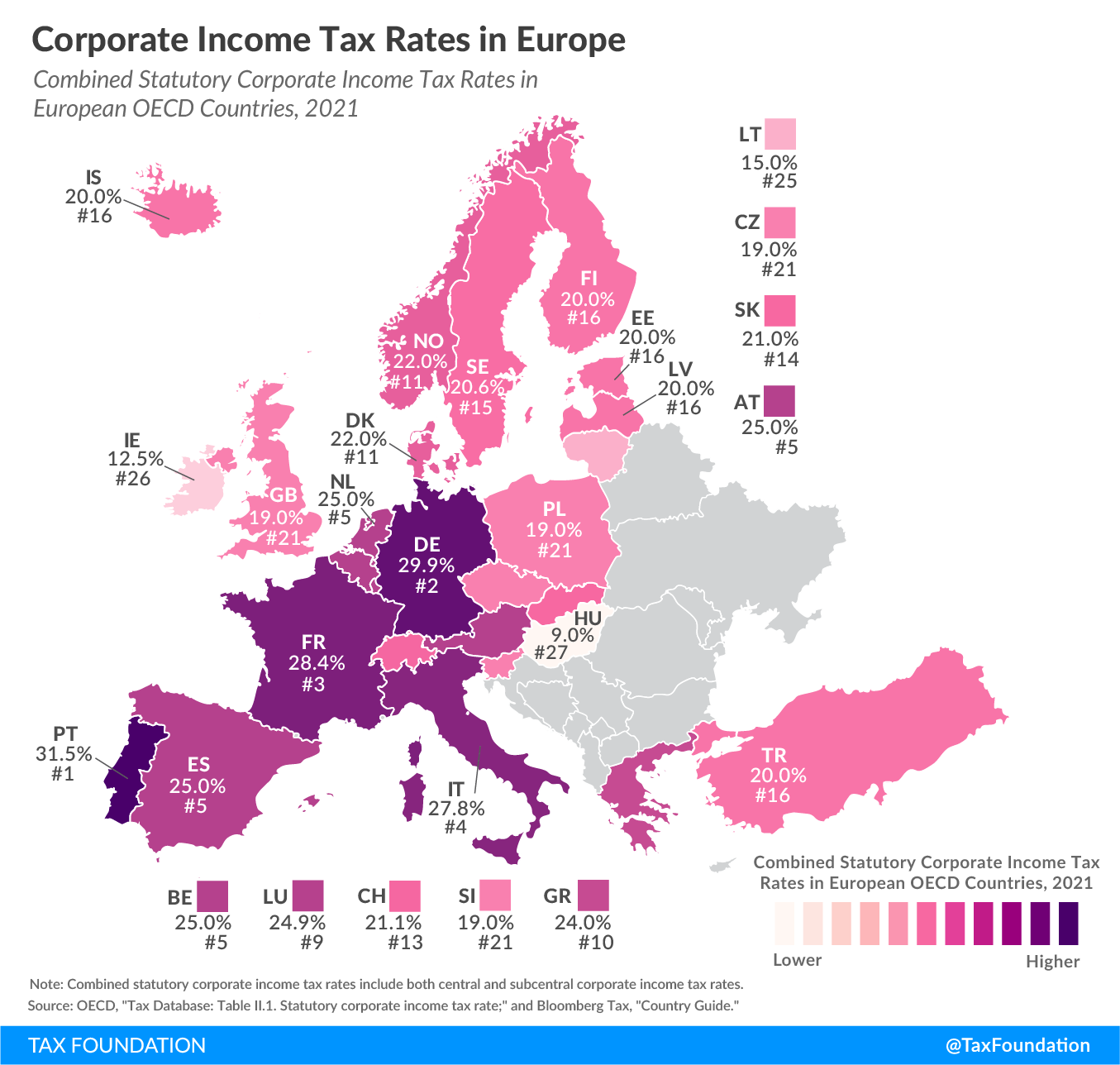

Biden’s proposed corporate tax hike—from 21% to 28%—would vault the U.S. back near the top of the industrialized world, eclipsing all European countries other than Portugal, France, and Germany. But because Biden’s proposal would also assess a global minimum tax on U.S. companies with revenues abroad, those companies would have a powerful incentive to sell themselves to foreign acquirers or to relocate outside the U.S., reducing U.S. employment.

Because U.S.-based companies will be taxed by the U.S. global revenues, along with that foreign revenue being taxed in the country of its origin (double taxation), Biden's corp tax hike will incentivize every co. with meaningful foreign revenue to relocate outside the U.S.

— Avik Roy (@Avik) April 28, 2021

In addition, a corporate tax hike on this scale would substantially reduce—and in some cases eliminate—the ability of companies to hire more workers, pay their existing workers more, or buy goods and services from other U.S. businesses. The costs to job and wage growth would be significant. The Tax Foundation estimates that raising the corporate tax rate to 28% would reduce U.S. employment by 138,000, and reduce wages by 0.6%.

In revenue terms, Biden proposes tax hikes that are three times as large as the tax cuts in the Tax Cuts and Jobs Act of 2017. Once the coronavirus recovery is completed, and the Federal Reserve has turned off its monetary stimulus, the effect of these tax increases will almost certainly be to reduce job and wage growth for those who most need it.