Higher education aspires to be a “great equalizer.” But according to FREOPP’s latest analysis of college return on investment (ROI), lower-income students are realizing far less financial value from college than their higher-income peers. Yet certain bright spots among colleges that serve lower-income students reveal a path towards making higher education pay off more consistently for this group.

FREOPP’s ROI analysis assesses the financial value of over 50,000 degree and certificate programs, including programs at traditional four-year universities, community colleges, and trade schools. ROI is the increase in lifetime earnings that a student can expect from a pursuing certain higher education program, accounting for the cost of college and the risk of not finishing. Programs with a negative ROI typically leave their students worse off.

Critically, the analysis also accounts for the fact that different schools serve different types of students. This is important because different groups of students have different earnings potential going into college. Given two programs with the exact same earnings after graduation, the program with the lower-income student body will generally have higher estimated ROI, because the analysis recognizes the lower preexisting earnings potential of that program’s students. The ROI figures thus give more “credit” to schools with lower-income student populations.

I match the ROI data to information on the socioeconomic status (SES) of each college’s student body, as measured by the school’s average Pell Grant per full-time equivalent student. As lower-income and lower-wealth students qualify for larger Pell Grants, a school with a higher average Pell Grant has a lower-SES student body. I then divide schools into four quartiles by the SES of their student populations and measure the median ROI within each of these quartiles.

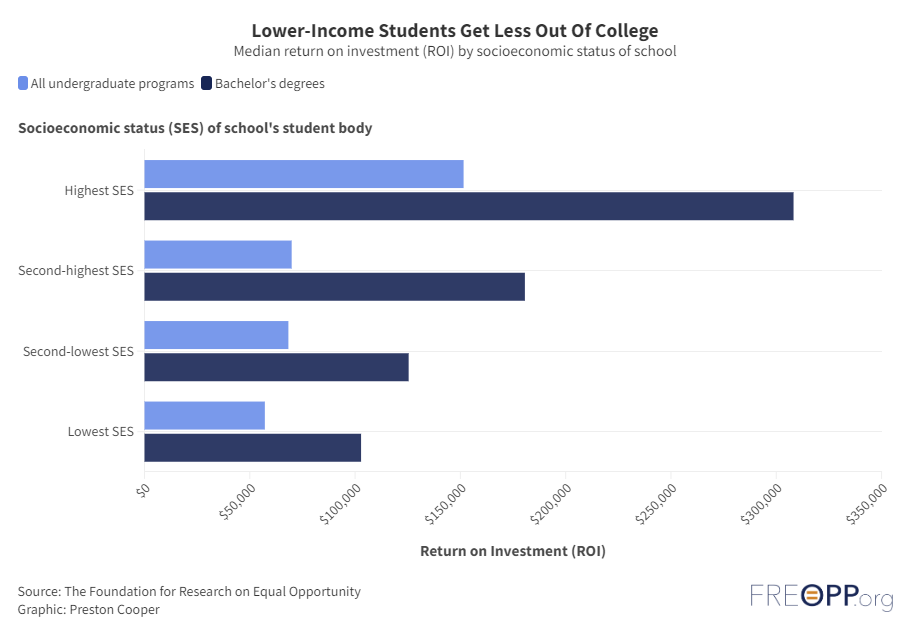

Schools serving lower-income students perform worse on ROI

Students attending the poorest schools realize a median ROI of just $57,000—and more than a third of these students are enrolled in programs where ROI is negative. By contrast, students attending the wealthiest schools enjoy an ROI of $152,000.

The same pattern holds if we limit the analysis to bachelor’s degree programs. At the lowest-SES schools, the median bachelor’s degree program delivers an ROI of $103,000. At the highest-SES schools, bachelor's degrees have a median ROI of $308,000; nearly three times higher.

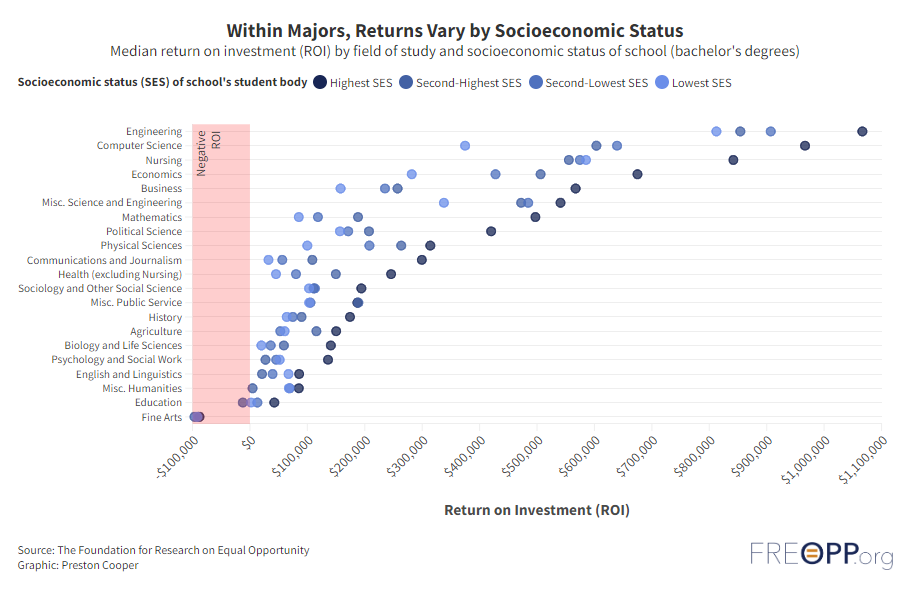

Schools serving higher-income students tend to have a better selection of college majors, from a financial perspective. For instance, engineering programs account for a larger share of enrollment at higher-SES schools than lower-SES schools. But even within the same fields of study, schools serving richer students tend to offer an advantage.

Consider students who major in communications and journalism. At high-SES colleges, median ROI for this field of study is nearly $300,000. But outside these richer institutions, the ROI of communications and journalism programs is abysmal: just $32,000 for the lowest-SES colleges.

(Interactive version of this chart)

There are several factors at play. Schools serving richer students are better plugged in to elite professional networks, which unlock higher salaries and better ROI. More than a quarter of journalists at the New York Times and the Wall Street Journal, for instance, graduated from an Ivy League or peer university. Communications and journalism students who attend colleges outside that ultra-prestigious circle may find it far harder to land one of the higher-paid jobs in their industry.

Completion rates are another factor. At four-year schools serving mostly high-SES students, 64 percent of students complete their degrees on time. At four-year schools serving mostly low-SES students, the on-time completion rate is just 31 percent. High dropout rates at low-SES schools mean low-income students are less likely to enjoy the benefits of a college degree, even as they are responsible for some of the costs.

Where higher education is serving low-income students well

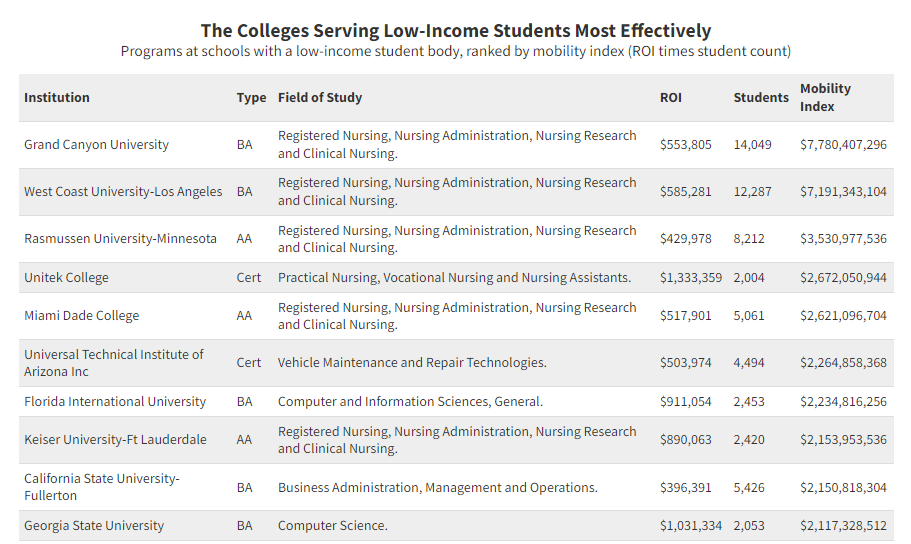

Fortunately, FREOPP’s ROI analysis has identified some bright spots. A measure called the “mobility index” multiplies each program’s ROI by the number of students it enrolls to arrive at a measure of the total economic value created by each program. Schools that enroll predominantly low-SES students boast 54 programs with a mobility index above $1 billion, as listed in the table below (click here for an interactive version).

The top program at low-SES schools is the registered nursing bachelor’s degree at Grand Canyon University, with an ROI of $554,000 and over 14,000 students. Several other nursing programs, including both two-year and four-year degrees, appear on the list.

The list includes a number of credentials below the bachelor's degree level, including certificate programs in vehicle maintenance and repair and licensed practical nursing. In the right fields of study, these programs offer a direct pathway into the labor force; they are relatively low-cost and short in duration, and boast high completion rates. Most importantly, they have inclusive admissions practices that make them accessible to lower-income students.

Several bachelor’s degree programs at low-SES colleges also appear on the list. In addition to the registered nursing programs, there are high-quality computer science programs at Florida International University and Georgia State University. The schools of the City University of New York system also make several appearances, especially in finance and accounting. Inclusive admissions practices, a high-value major, and strong completion rates can be a winning combination for low-income students.

Improving the value of higher ed for low-income students

The existing higher education system is serving lower-income students poorly, at least relative to their higher-income peers. Fortunately, there are examples of programs that where lower-income students tend to do quite well. These should act as models for other schools.

Policymakers should give colleges the best incentives to do right by their low-income students. One idea is to boost Pell Grant aid for low-income students enrolled in high-ROI programs; another is to condition state funding for public universities on strong earnings outcomes for disadvantaged students. With the right encouragement, higher education can do better for this underserved population.