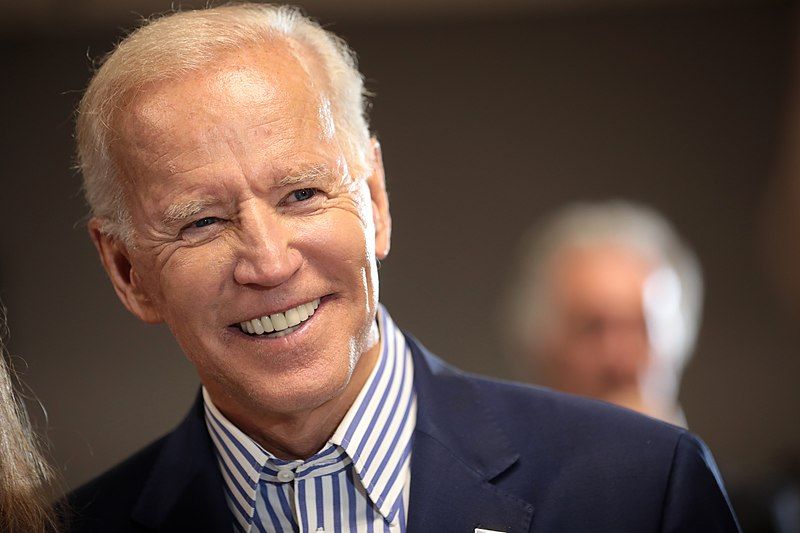

Increasingly, presidents of both parties prefer to act by administrative fiat rather than engage in the messy business of trying to pass legislation. The Trump administration preferred this method, for instance, regarding immigration policy. More recently, the Supreme Court just struck down President Biden’s attempts to unilaterally eliminate over $400 billion of student loan debt. Now the Biden administration appears poised to quietly take unilateral action on welfare policy that will affect who receives government benefits and how much the government spends on anti-poverty programs.

Responding to a new report from the National Academy of Sciences, Engineering, and Medicine, the Biden administration is considering replacing the current official poverty measure (OPM) with the Census Bureau’s supplemental poverty measure (SPM). While this may seem like an arcane and largely academic change, Kevin Corinth of the American Enterprise Institute warns that switching poverty measures could effectively raise the poverty line by 20 percent in 2024 and by 34 percent within 10 years.

Because Congress has tied eligibility for most major welfare programs to the poverty standard, switching from the OPM to the SPM would significantly increase both the number of people receiving government assistance and the cost of the programs affected by such a change. For instance, Corinth estimates that over the next decade it would increase spending on SNAP by $47 billion and Medicaid by $78 billion. It would also shift funding from low-cost states such as West Virginia to high-cost states such as California, where the poverty threshold would rise substantially.

Nearly all observers concede that the official poverty measure is deeply flawed. The average family budget has changed significantly since the OPM was developed. Food, for instance, now comprises only about one-seventh of the average family’s budget, rather than the one-third used by the OPM. At the same time, expenses that carried little weight in the 1960s, such as health care, childcare, and housing, now consume a much higher share of family income. Nor does the OPM capture the value of most government benefits, particularly tax credits and in-kind benefits. Yet, those benefits, which include the Earned Income Tax Credit, Medicaid, SNAP, housing, and other large scale social welfare programs, account for the vast majority of benefits received by low-income Americans. Nor does the OPM reflect the wide variation in cost-of-living across the country. Identical incomes mean very different things in, say, Los Angeles vs. the Mississippi Delta.

But the SPM has flaws of its own. For example, while the SPM does a better job of gathering up the total number of poor Americans, it actually does a worse job of identifying those most in need. A study by Bruce Meyer and James Sullivan used consumer expenditure data to compare families that were poor under an OPM-type measure with those considered poor under a more SPM-like measure. They found that SPM-only poor families were actually better off than OPM-only poor families on all general measures of hardship. Other studies have reached similar conclusions.

In addition, the SPM is a quasi-relative measure of poverty that tends to measure inequality more than absolute poverty.

Finally, while tying poverty levels to cost-of-living delivers a better look at the actual material conditions, tying benefits to the SPM would effectively reward states with policies that drive-up costs. For instance, California's welfare recipients would receive higher benefits because the state’s housing policies inflate rents.

None of this is to say that switching from the OPM to the SPM is necessarily a bad idea, given the problems with the current OPM. But certainly, there are too many ramifications for such a change to take place without a full and open debate. The Biden administration shouldn't be imposing potentially enormous new costs that taxpayers would have to shoulder without the sort of clear legislative authorization that the Supreme Court has said is required before such consequential regulatory changes can take effect. Congress should be actively involved in the decision.

But this debate is also an opportunity to discuss the larger question of how policymakers measure poverty and whether they should look at it in an entirely different way.

Assuming basic scientific accuracy, there is not a single right or wrong way to measure poverty. As philosopher and Nobel Prize-winning economist Amartya Sen notes, the definition of poverty can encompass a broad range of possibilities “from such elementary things as being adequately nourished, being in good health, avoiding escapable morbidity and premature mortality, etc., to more complex achievements such as being happy, having self-respect, taking part in the life of the community, and so on.” That leaves a lot of room for interpretation. Any measure is going to reflect the biases and preferences of the measurer.

Further complicating the problem, scholars, politicians, and special interests often want the poverty measure to do more than measure poverty. Progressive politicians, for example, may want to use a more expansive poverty definition to build support for government programs, while conservatives may seek to minimize poverty to justify spending cuts.

It would be a mistake, therefore, to become too heavily invested in any set of numbers. Instead, Congress should decouple program eligibility from any specific poverty measure. Eligibility should be developed on a program-by-program basis calibrated to the goals of that particular program.

At the same time, policymakers should begin to look at poverty in a larger more holistic context that considers not just a person’s material circumstances, but also their capabilities to become self-sufficient. Doing so would allow for the development of an approach to fighting poverty based less on an individual’s financial condition at a point in time, and more on their ultimate ability to flourish in our society.